|

УДК 336.7:368 |

Kononenko A. |

Evaluation of Joint Activity of Banks

and Insurance Companies

While considering the problem of economic integration, one can remark that, in general, globalization tendency in all the spheres of economic activity becomes more noticeable. On the international scale such questions are characterized, first of all, by the development of the universal international system.

The following situation, in which numerous market participants can’t find the opportunity of adapting to the changeable conditions of economic management, is typical nowadays. As a result of this situation, its participants become outsiders. For example, in the USA, where economics is at a high level now, every year thousands of companies go bankrupts.

To my mind, in order to stand in the competitive struggle it’s necessary to work ‘one step forward’. Western businessmen realized that it was more efficient to be guided by common interests than to act independently.

In Ukraine the similar process began comparatively a while ago. The creation of finance industrial groups was its first step. The most vivid example of the integration of financial institutions was the joint activity of banks and insurance offices. In the USA the bank insurance is the most attractive for the creation of image as well as for getting much profits. Nowadays more than 80% of the European banks use in their activity bank insurance and more than 40% of the insurance companies offer their clients alternative financial services [1]. The first and the second ones can increase the economic efficiency of their activity and offer the enlarged range of services.

There are some universal concepts of bank insurance development. These are the concepts of:

using the same clientele by insurance companies and banks;

concluding the contracts of extending the product resources;

agreement on mutual holding of shares;

creating a new joint enterprise;

creating or buying the bank belonging (completely or partially) to the insurance company.

Finance advantage for banks may be reflected as follows:

1) increasing the profit at the expense of the commissions;

2) decreasing the effect of fixed charges of the bank, which are extended to the life insurance;

3) the possibility of increasing the labour productivity of employees, since they become able to offer much wider range of services.

The tendency of refusal of depositing and transfer to the insurance products with larger amounts of funds is characteristic of middle- and long-term investments. It causes the reduction of personal savings on deposit, and therefore the reduction of bank profit.

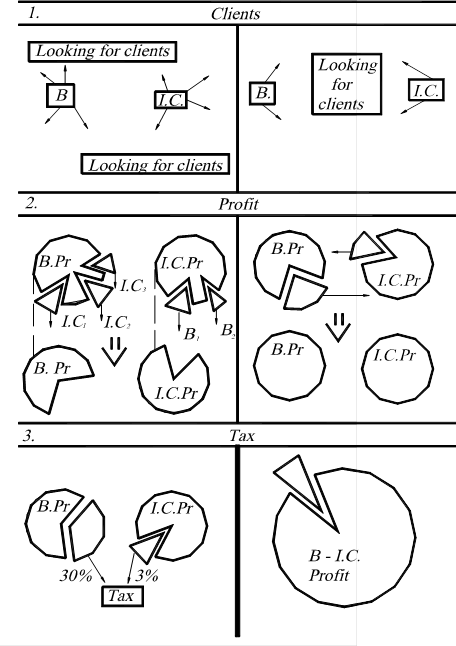

Another important reason making bankers and insurance officials to diversify the offered product is favourable tax policy. For the insurance offices taxes are 3% and for banks — 30% [2].

Much attention is paid to the analysis of consumers’ preferences. The companies try to attract as many clients as possible. It’s considered that the more products the consumer buys from the company the less the possibility of loosing this client. It’s evident that only complex solution can help to attract a new client.

The range of insurance services has been enlarged in Ukraine recently. But some kinds of services don’t really operate in Ukraine. In fact life insurance is not spread in Ukraine. That’s because of low trust of population in the financial companies. Life insurance, to my mind, can enlarge the number of clients of banks and insurance offices. This can be illustrated by means of the chart of selling insurance services in Western Europe. An insurant chooses the long-term life insurance to cover future spending on education. At the same time he can obtain mortgage credit and the bank will get profit when the insurance event occurs.

Separate activity Joint activity

Figure. Comparative Description of Joint

and Separate Activity of Banks

Уважаемый посетитель!

Чтобы распечатать файл, скачайте его (в формате Word).

Ссылка на скачивание - внизу страницы.