APPLIED STOCHASTIC MODELS IN BUSINESS AND INDUSTRY

Appl. Stochastic Models Bus. Ind. 2010; 26:205–223

Published online 13 February 2009 in Wiley InterScience (www.interscience.wiley.com). DOI: 10.1002/asmb.763

Trend estimation of financial time series

V´ıctor M. Guerrero∗,† and Adriana Galicia-Vazquez´

Department of Statistics, Instituto Tecnologico Aut´ onomo de M´ exico´ (ITAM), Mexico D. F. 01080´ , Mexico

SUMMARY

We propose to decompose a financial time series into trend plus noise by means of the exponential smoothing filter. This filter produces statistically efficient estimates of the trend that can be calculated by a straightforward application of the Kalman filter. It can also be interpreted in the context of penalized least squares as a function of a smoothing constant has to be minimized by trading off fitness against smoothness of the trend. The smoothing constant is crucial to decide the degree of smoothness and the problem is how to choose it objectively. We suggest a procedure that allows the user to decide at the outset the desired percentage of smoothness and derive from it the corresponding value of that constant. A definition of smoothness is first proposed as well as an index of relative precision attributable to the smoothing element of the time series. The procedure is extended to series with different frequencies of observation, so that comparable trends can be obtained for say, daily, weekly or intraday observations of the same variable. The theoretical results are derived from an integrated moving average model of order (1,1) underlying the statistical interpretation of the filter. Expressions of equivalent smoothing constants are derived for series generated by temporal aggregation or systematic sampling of another series. Hence, comparable trend estimates can be obtained for the same time series with different lengths, for different time series of the same length and for series with different frequencies of observation of the same variable. Copyright q 2009 John Wiley & Sons, Ltd.

Received 6 August 2008; Revised 14 January 2009; Accepted 14 January 2009

KEY WORDS: ARIMA models; comparability; generalized least squares; Kalman filter; penalized least squares; smoothing constant; time domain analysis

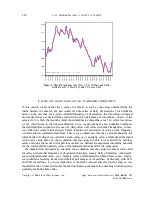

This article is concerned with the problem of decomposing an observed financial time series into two unobserved components, trend and noise. The basic goal of such type of analysis is to enable

![]()

∗Correspondence to: V´ıctor M. Guerrero, Department of Statistics, Instituto Tecnologico Aut´ onomo de M´ exico´ (ITAM), Mexico D. F. 01080, Mexico.´

†E-mail: guerrero@itam.mx

Contract/grant sponsor: Asociacion Mexicana de Cultura, A. C.´

the analyst to study the behavior of each component separately, on the assumption that they have different causal forces.

In an economic context, there is a tradition for decomposing time series into components such as trend, seasonal and irregular by means of statistical packages like X-12-ARIMA (see Findley et al. [1]) or TRAMO-SEATS (Gomez and Maravall´ [2]) which are easy to use and enable the analyst to carry out a very thorough time series analysis. Another method commonly employed to decompose an economic time series consists of an application of the Hodrick–Prescott (HP) filter (see Hodrick and Prescott [3]). In most cases the observed series is assumed to be I(2) (Integrated of order 2) as indicated by Maravall [4]. Nevertheless, as a referee pointed out ‘There is no reason why the methodology of SEATS cannot handle an I(1) specification, but the software tends to favor the I(2) specification.’ Something similar occurs with the X-12-ARIMA methodology.

On the other hand, when working with financial time series, a usual assumption is that the series behaves as a random walk, that is, as an I(1) process. For instance, Baillie and Bollerslev [5] found that the exchange rates of several currencies against the U.S. Dollar behave as random walks. Similarly, Narayan and Smyth [6] showed that the stock prices of the Organization for Economic Co-operation and Development countries should be considered I(1) processes. Moreover, Tsay [7] uses a random walk with drift as a conventional model for prices. Thus, the random walk model plays a central role in the financial literature. To be consistent with this idea, since we are interested in decomposing a financial time series into trend plus noise, we should use the exponential smoothing (ES) filter rather than the HP filter. The distinction between these filters is thoroughly exposed by King and Rebelo [8]. For our purposes it suffices to say that the ES filter employs an I(1) representation for the trend, while the HP filter uses an I(2) representation.

Уважаемый посетитель!

Чтобы распечатать файл, скачайте его (в формате Word).

Ссылка на скачивание - внизу страницы.