Taxation is in fashion

Warm up:

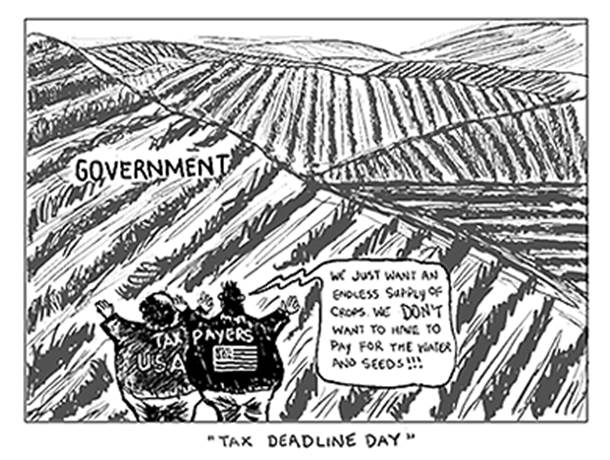

Ask students to look at the cartoon on the opposite page and discuss the following questions:

· What is happening in this cartoon?

· Explain the meaning of the caption, “We just want an endless supply of crops. We don’t want to have to pay for the water and seeds.”

· How valid is the cartoonist’s view about taxpayers? Do the students’ opinions coincide with the cartoonist’s one?

· What questions does this raise for us to consider? (How important is it that we file our taxes correctly and on time?)

Objective objectives.

Start introducing objectives of the class to the students and ask them to prolong the list.

After completing this activity you will be able to:

· Discuss basic principles of taxation and the rationale for imposing taxes;

· Examine different kinds of taxes and compare them with taxes in Belarus;

· Analyze a number of tax tips intended for American college students.

Ask students which of the objectives interests them most and if you had an expert in class, what questions would they ask about taxes?

Project work

Explain that in this activity students will be required to complete a project about the topics referred to in the objectives.

Based on what students learn about taxes from information bank andafterfulfilling the necessary tutorials, they will have the choice of completing one of the three types of projects below.

1) teaching a lesson

2) writing a brief chapter in a textbook

3) creating a multiple choice test.

Before getting down to project work ask students to answer the following questions:

· What do you know about the components of a good lesson?

· What do you know about the qualities of a well designed textbook?

· What do you know about the features of a valid multiple choice exam?

Discuss with the class your specifications and expectations for the projects, including deadlines, criteria for grading their lessons, textbook chapters, and multiple choice tests, and format.

Explain to students that most of the information for their projects should come from reading the bank of information and fulfilling tutorials Divide the class into three groups. Assign each group a different one of the following abstracts and related websites to read: Tax basics - Tax: 1. Purposes and effects; 1.1. TheFour“R”s(http://en.wikipedia.org/wiki/Tax); Tax fair sounds fair. Tax: 5. Kinds of taxes http://en.wikipedia.org/wiki/Tax;

Taxation in Belarus http://www.belarus.by/en/invest/investmentclimate/taxation#tax_overview; Ten things to remember. Ten Things an American College Student Should Remember at Tax Time.doc. All the necessary web-pages you can find in the Bank of information folder.

After their reading, have the students explain their answers to the following questions:

· What information did you find on the pages and websites you read?

· Discuss one important thing that you learned about taxes that you didn’t know before.

· What questions do you have about completing your project?

Summary:

Ask students to explain their answers to the following question: What do you hope to learn by completing this project

Warm up:

Project 1 Teach a lesson

Write a lesson plan about taxes and then teach the lesson to your class. The lesson should examine basic ideas about taxes, information about kinds of taxes, and the importance of paying taxes on time. This lesson should refer to what you learned about taxes, where your tax money goes, and preparing tax filing tips for college students.

To prepare for your project, you’ll need to access the three tutorials on the pages indicated below. Follow the directions that come with the tutorials. After completing these tutorials, you’ll be ready to start your project.

Project 2 Write a short chapter in a textbook

Write a two-page chapter in a textbook in which you explain some basic ideas about taxes, kinds of taxes, and the importance of paying taxes on time. This chapter should refer to what you learned about taxes, where your tax money goes, and preparing tax filing tips for college students.

To prepare for your project, you’ll need to access the three tutorials on the pages indicated below. Follow the directions that come with the tutorials. After completing these tutorials, you’ll be ready to start your project.

Project 3: Create a multiple choice test

Create a 15-question multiple choice test that covers the basic ideas about taxes, kinds of taxes, and the importance of paying taxes on time. This test should refer to the important facts and concepts you learned in the tutorials below about taxes, where your tax money goes, and preparing tax filing tips for college students.

To prepare for your project, you’ll need to access the three tutorials on the pages indicated below. Follow the directions that come with the tutorials. After completing these tutorials, you’ll be ready to start your projects.

Tutorial 1: Tax basics

Access: Tax: 1. Purposes and effects; 1.1. The Four “R”s (http://en.wikipedia.org/wiki/Tax) +Bank of information folder

Answer the following questions, based on what you have read:

· Explain what tax and taxation mean.

· How do the the governments use funds provided by taxation? Do you think the usage is optimal? Explain your point.

· Why do some economists oppose taxation? Do you share their point of view?

· What do Four “R” stand for?

· Present three arguments that you would make to someone who says that citizens should not pay their taxes.

Tutorial 2:Tax fair sounds fair.

Access: Tax: 5. Kinds of taxes http://en.wikipedia.org/wiki/Tax; Taxation in Belarus http://www.belarus.by/en/invest/investmentclimate/taxation#tax_overview +Bank of information folder

The task is to compare general kinds of taxes described in Wikipedia with those really functioning in Belarus.

Summarize information about the taxation system in Belarus based on the knowledge you’ve got? What is your opinion about the system? Do you think it needs changes? If yes can you offer any?

Tutorial 3: Ten Things an American College Student Should Remember at Tax Time

Access Ten Things an American College Student Should Remember at Tax Time.doc (Bank of information folder)

Answer the following questions:

· Describe the three tax tips that impressed you the most.

· Why would it be a good idea for every college student to read this web page before filing his or her tax return?

· Why would the author agree with the following advice: “Don’t automatically file a 1040 EZ form. Don’t mail your tax return the moment you finish it and file a return, even if you’re not required to do so?”

· Explain the differences between the following: tax credits and/or deductions: Hope Scholarship Tax Credit/ Lifetime Learning Credit/ Higher Education Expenses Deduction.

· Which is the most important of the 12 tax tips? Explain.

Уважаемый посетитель!

Чтобы распечатать файл, скачайте его (в формате Word).

Ссылка на скачивание - внизу страницы.