Thus, we decided that the most perspective segment that would be reasonable to focus on is busy people.

On the French market dried crusts are not sold. However, there are a lot of substitutes like:

· Chips/crisps

· Chocolate bars

· Curd desserts

· Cookies

· Nuts

· Yougurt

· Croissants

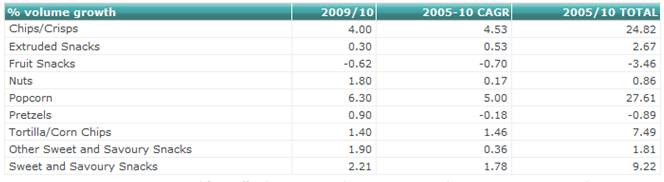

From the table below we can see that segments of chips/crisps and popcorn demonstrate the fastest growth. Chips/crisps recorded the highest growth rate in volume and value terms in 2010. Strong innovation focused on the development of new flavors from leading manufacturers helped sustain consumption. The launches of lighter recipes also helped the chips/crisps manufacturers to extend their core target and increase penetration. PepsiCo France SNC, the leader in chips/crisps, launched a range called “Cuites au Four”, which contains 70% less fat. Introduced in 2008, the company has since extended this range with new flavors due to the success the range has enjoyed.

Popcorn is not so popular in France. With sales of an estimated 3,280 tonnes in 2010, popcorn accounts for 2% of the overall volume of sweet and savoury snacks. Microwave popcorn accounted for a 35% retail value share in 2010. Popcorn suffers from difficulties with merchandising. There is confusion in France about the best merchandising strategy to adopt for popcorn. In some retailers, popcorn can be found among the fruit and vegetables, while in others it can be found with products aimed at the aperitif moment.

Sales of Sweet

and Savoury Snacks by Category: Volume 2005-2010

Sales of Sweet

and Savoury Snacks by Category: Volume 2005-2010

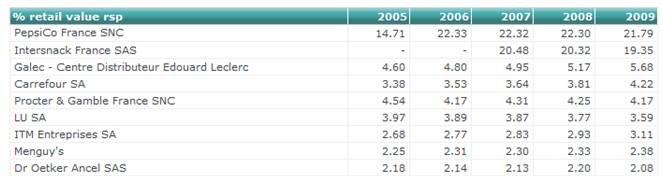

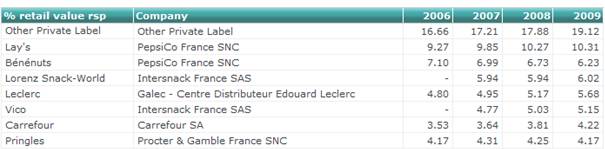

The biggest shares on the French snack market belong to PepciCo France SNC and Intersnack France SAS. PepsiCo France SNC led sales in 2009 with a 22% retail value share. Its wide portfolio of brands positioned across every subcategory of sweet and savory snacks has helped the company to maintain a strong presence. The multinational operates through key brands in each subcategory, for example Lay’s in chips/crisps, which held a 34% share in 2009, and Bénénuts in nuts, with a 17% share in 2009. Its high marketing investments combined with a strong innovation policy ensured the multinational remained the leader in sweet and savory snacks. Its strategy towards naturalness with the launch of healthier recipes largely contributed to PepsiCo France SNC’s long-lasting success.

Intersnack France SAS saw the biggest decrease in value sales, losing one percentage point in share on 2008 to 19% in 2009 in sweet and savory snacks. The company has particularly suffered from strong competition with private label.

Sweet and

Savoury Snacks Company Shares 2005-2009

Sweet and

Savoury Snacks Company Shares 2005-2009

Sweet and

Savoury Snacks Brand Shares 2006-2009

Sweet and

Savoury Snacks Brand Shares 2006-2009

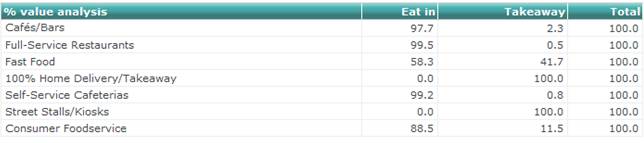

We also consider cafés and restaurants as

competitors. The level of takeaway food especially fast food is rather high.

Main trends on French snack food market

French food industry was influenced by health trend among consumers. Most players of the industry tried to adopt their products to changing consumer eating behavior and put efforts into developing and launching healthier meals. For example, in bakery industry, actors put on the market different types of breads or used fresher ingredients (vegetables). Fast-food restaurants such as Subway or McDonald`s offered nutritionally-balanced meals or low-calorie sandwiches.

Hectic consumers` lifestyle in France and reduced lunchtime resulted in the appearance of “on-the-go” trend in the market which led to the increasing popularity of different snacks. 20 years ago French consumer spent on lunch approximately 1 hour - 3 times more than nowadays. French people tend to snack several times during the day. They regard snacks as cheap substitutes to more conventional food or dinner in full-service restaurant. Reduced purchasing power which is the result of the downturn made consumers eat more snacks because they found such meal convenient and fast. Moreover, snacks are cheaper in comparison with other foodservice types such as full-service restaurants.

Уважаемый посетитель!

Чтобы распечатать файл, скачайте его (в формате Word).

Ссылка на скачивание - внизу страницы.