The companies YUKOS and "Sibneft" have announced about fusion. The new company will be named "YukosSibneft" and becomes the fourth petroleum company in the world on volumes of production. The new company will be headed by the chairman of government of YUKOS Mikhail Khodorkovsky, the chairman of board of directors becomes the president of "Sibneft" Evgeny Shvidler. It is supposed, that the majority in board will be independent directors.

The basic shareholders of "Sibneft", which now supervise 94 % of this companies, will sell 20 % for $3 bln. Other shares of "Sibneft" will be changed on the share of "YukosSibneft " on factor 0,36125 to 1 share.

The stocks "YukosSibneft " (in view of reserves of the company "Slavneft") will make 19,4 bln.bbl petroleum equivalent. The production of the company (including a share of the company "Slavneft" in production "Slavneft ") will make about 2,3. bln.bbl per day.

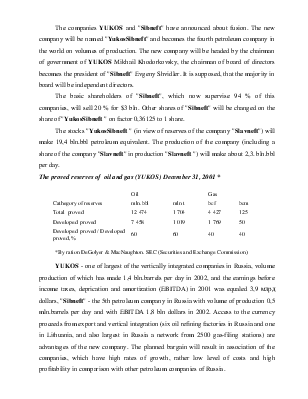

The proved reserves of oil and gas (YUKOS) December 31, 2001 *

|

Oil |

Gas |

|||

|

Cathegory of reserves |

mln.bbl |

mln t |

bcf |

bcm |

|

Total proved |

12 474 |

1 704 |

4 427 |

125 |

|

Developed proved |

7 458 |

1 019 |

1 769 |

50 |

|

Developed proved / Developed proved, % |

60 |

60 |

40 |

40 |

*By ration DeGolyer & MacNaughton. SEC (Securities and Exchange Commission)

YUKOS - one of largest of the vertically integrated companies in Russia, volume production of which has made 1,4 bln.barrels per day in 2002, and the earnings before income taxes, deprication and amortization (EBITDA) in 2001 was equaled 3,9 млрд dollars, "Sibneft" - the 5th petroleum company in Russia with volume of production 0,5 mln.barrels per day and with EBITDA 1,8 bln dollars in 2002. Access to the currency proceeds from export and vertical integration (six oil refining factories in Russia and one in Lithuania, and also largest in Russia a network from 2500 gas-filing stations) are advantages of the new company. The planned bargain will result in association of the companies, which have high rates of growth, rather low level of costs and high profitability in comparison with other petroleum companies of Russia.

The comparative characteristic YUKOS and "Sibneft"

|

YUKOS |

"Sibneft" |

|||||

|

Credit rating of company |

BB/Stable/- |

B+/Negative/- |

||||

|

As of Desember 31 |

2001 |

2000 |

2001 |

2000 |

||

|

Operation indications Proved reserves of oil, mln bbl |

1 303 |

1 314 |

644 |

638 |

||

|

Equivalent, mln bbl. |

9 552 |

9 626 |

4 644 |

4,599 |

||

|

Oil production, млн т |

58,1 |

49,6 |

20,7 |

17.2 |

||

|

Equivalent, thousands/ day |

1 153 |

995 |

408 |

338 |

||

|

Export/ Oil production, % |

48,2 |

45,2 |

35,3 |

32.5 |

||

|

Petroleum products export, % from oil production of YUKOS |

17,0 |

15,1 |

11,1 |

13.7 |

||

|

Oil refining / Oil production, % |

43,2 |

39,0 |

64,3 |

73.0 |

||

|

Factor of use capacity refineries, % |

62,1 |

69,8 |

69,0 |

64.9 |

||

|

Financial indications Net proceeds, mln $. |

7 998 |

8 210 |

3 332 |

2,398 |

||

|

EBITDA, mln $.. |

3 907 |

4 973 |

1 801 |

992 |

||

|

EBITDA/ Net proceeds , % |

48,8 |

60,6 |

54,1 |

41.4 |

||

|

EBITDA/bbl. produced oil, $. |

9,28 |

13,70 |

12,08 |

8.04 |

||

|

EBIT/ proceeds, % |

45,5 |

57,9 |

44,6 |

28,8 |

||

|

Operation money flow/summary arrears, % |

483 |

540 |

138 |

152 |

||

The credit status "Sibneft" will be leveled with credit status " YUKOS " in process of association of the companies and will base on credit quality of the incorporated company - "YukosSibneft". As it is supposed, "Sibneft" will leave from the list CreditWatch, when the conditions of the agreement and will be finally clear when the bargain will be officially approved by assemblies of the shareholders and regulating bodies. The ratings " Sibneft " will be leveled with ratings "YukosSibneft ", if the interests of its creditors will not be restrained by structure of the bargain.

Standard and Poor's believes, that the incorporated company, as well as YUKOS and "Sibneft", will demonstrate high parameters of money flows, profit, of operational efficiency and realizes advantage of some increase diversification of assets. However as practically all basic assets are located in Russia, the company will be subject to risks connected to business dealing in Russian Federation (a rating on the obligations in national currency: ВВ +/stable; a rating under the obligations in foreign currency: ВВ/STABLE), and also risks reflecting branch specificity, such as high sensitivity to fluctuations of the prices on petroleum, transport restrictions, low prices of petroleum on a home market, changeable and not always transparent system of regulation. The credit status of the new company will depend appreciably on financial policy, and also level of the debt and reserves of liquidity after end of merge.

Уважаемый посетитель!

Чтобы распечатать файл, скачайте его (в формате Word).

Ссылка на скачивание - внизу страницы.