Chapter 7: Corporate Level Strategy – Mix and Composition of

Business Units

Corporate portfolio approaches

Experience curve -- Economies of scale -- On stars, cash cows, question marks and dogs

Cash flow, return on investment, and industry life cycle

Why my Zeide rode in a car on the Sabbath

*

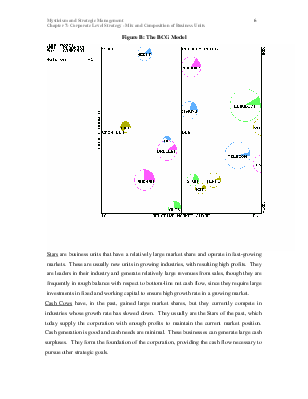

This book focuses on both business level and corporate level strategy. Corporate level strategy has to do with the mix and composition of the corporation’s business units. There are several corporate portfolio approaches to review the business units’ mix and composition. The growth-share matrix, generally known as the BCG (Boston Consulting Group) matrix, was the first corporate portfolio approach developed. This two-dimensional presentation of business unit positions, determined by market growth rate and relative market share, had an immediate and profound effect on corporate strategy making in the U.S.A. and the world. The development of the matrix was an outgrowth of the work done by the Boston Consulting Group on experience-curve effects, which indicated that variable cost per unit decreases by 10% to 30% every time production experience (accumulated volume) is doubled. It was found that in any market segment of an industry, price levels tend to be very similar for similar products; therefore, what makes one company more profitable than the next must be the levels of its costs. The experience-curve phenomenon is presented below. The other cornerstone for the BCG growth-share matrix is the product life cycle concept, which has been with us for many decades, and has already been presented in this book. (Its graphs show the rise, stabilization and decline over time of product sales for all competitors combined, as well as the number of competitors and industry profits.)

*

The experience-curve phenomenon lies behind the growth-share matrix and corporate strategy: costs decrease by a certain characteristic percentage each time that a doubling occurs in the cumulative number of units manufactured, distributed and sold. Experience-curve

Copyright © 2006 Eli Segev

principles have taught that when the number of times a task is performed doubles, the variable cost of performing that task declines by approximately 20 percent. The experience-curve concept observes that overall costs associated with a product line decline with time in the manner of learning curve behavior. When cost per unit is plotted on a log-log scale against cumulative total units, the result is a straight line. The experience curve has no thresholds, and is applied to ALL functions: purchasing, production, accounting, marketing, and the like.

The experience curve illustrates the advantages of:

Lower production costs,

Lower distribution costs (distribution strength of the organization are existing distribution links with retail and wholesale customers, its reputation in the trade, sales force skills and its physical distribution network; also included are capacity and length of the distribution channels), and Lower selling costs of a particular product due to accumulated experience.

The concept states that the total constant-dollar-per-unit cost of producing, distributing, and selling a particular product will decline by a constant percentage (usually between 10 and 30 percent) with every doubling of the accumulated production volume in units. Thus the experience curve effect is very important in fast-growing markets, which accumulate experience very quickly. The following chain is assumed for the business unit:

• High accumulated volume, implies,

• Low unit cost, implies,

• High profitability.

Experience-curve effects can be measured at all stages of the value-added chain. The user is not required to calculate the experience-curve slope for each link of the chain, but rather to make a subjective assessment of the overall experience of the business unit by separate factors at each link, relative to other competitors. The factors are:

personal learning of a task, standardization of a task performed many times, product and process improvements, methods and system rationalization introducing automation and computerization, economies of scale.

The business unit may gain advantages by producing large batches, with minimal setup time between batches; cost advantages may also be gained by large procurement orders, allowing for reductions from suppliers, or the simultaneous delivery of large quantities to several customers.

EXAMPLE: When movie star Tom Hanks wanted to create an expensive TV drama, he knew that he had to go to HBO. Why was HBO the only company willing to produce From the Earth to the Moon, at a cost of over 60$ million? The obvious answer is size. HBO dominates the pay-cable networks market of 34 million customers, much more than its rivals. Therefore, the investment HBO made was distributed over a large number of customers. The more clients HBO has the cheaper the movie gets. Therefore, HBO’s main objective is to increase

the number of clients it has. (Source: Business Week, 1997, "Call it Home Buzz Office," December 8, pp. 77-80.)

Уважаемый посетитель!

Чтобы распечатать файл, скачайте его (в формате Word).

Ссылка на скачивание - внизу страницы.