Wi$e Credit

Warm up:

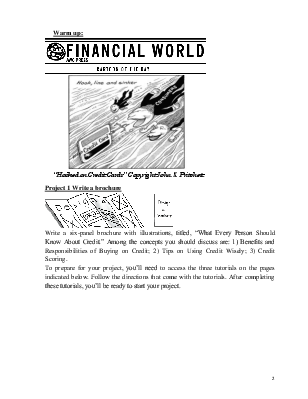

Ask students to look at the cartoon on the opposite page and explain the answers to the following questions:

· What’s happening in the cartoon?

· How can you explain the title “Hooked on Credit Cards?”

· What message does this cartoonist want to deliver about credit?

· Are there good and bad ways to use credit?

· What questions about credit does this discussion raise? (“How can we use credit wisely?”)

Objective objectives.

Start introducing objectives of the class to the students and ask them to prolong the list.

After completing this activity you will be able to:

· Discuss the benefits and responsibilities of using credit

· Explain how credit scoring works

· Make suggestions about using credit wisely

Ask students which of the objectives interests them most and if you had an expert in class, what questions would they ask about credit and crediting?

Project work

Explain that in this activity students will be required to complete a project about the topics referred to in the objectives.

Based on what students learn about credits and crediting from information bank, they will have the choice of completing one of the two types of projects below.

1) Writing a brochure

2) Creating a set of posters

Before getting down to project work have students explain their answers to the following questions:

· What do you know about the features of an informational brochure?

· What do you know about creating a poster that delivers a public service message?

Discuss with the class your specifications and expectations for the projects, including deadlines;criteria for grading their brochures, andposters; and other details about the project.

Explain to students that most of the information for their projects should come from reading the bank of information and fulfilling tutorials Divide the class into two groups. Assign each group a different one of the following abstracts and related websites to read:

Advantages and disadvantages of buying on credit. http://www.mtstcil.org/skills/budget-12.html / or The Importance of Managing Money.doc/ Bank of information folder

Using credit wi$ely Using Credit Wisely.pdf/Bank of information folder;

Credit scoring

http://www.ftc.gov/bcp/edu/pubs/consumer/credit/cre24.htm./Bank of information folder

After completing their readings, have the students explain their answers to the following:

· Describe what you found on these pages.

· What did you learn from the material you read?

· What questions do you have about completing your project?

Summary:

Ask students to explain their answers about the following question:

What do you expect to learn by completing this project?

Warm up:

“Hooked on Credit Cards” Copyright John S. Pritchett

Project 1 Write a brochure

Write a six-panel brochure with illustrations, titled, “What Every Person Should Know About Credit.” Among the concepts you should discuss are: 1) Benefits and Responsibilities of Buying on Credit; 2) Tips on Using Credit Wisely; 3) Credit Scoring.

To prepare for your project, you’ll need to access the three tutorials on the pages indicated below. Follow the directions that come with the tutorials. After completing these tutorials, you’ll be ready to start your project.

Project 2 Create a set of posters

Create a set of three posters, including illustrations, on the theme, “What Every Teenager Should Know About Credit.” Among the concepts you should address are: 1) Benefits and Responsibilities of Buying on Credit; 2) Tips on Using Credit Wisely; 3) Credit Scoring.

To prepare for your project, you’ll need to access the three tutorials on the pages indicated below. Follow the directions that come with the tutorials. After completing these tutorials, you’ll be ready to start your project.

Tutorial 1: Advantages and Disadvantages of Buying on Credit

Access http://www.mtstcil.org/skills/budget-12.html / or The Importance of Managing Money.doc/Bank of information folder

Read the material on the advantages and disadvantages of using credit cards. Based on what you read, explain your answers to the following questions:

· What are the major advantages of using credit cards?

· What are the major disadvantages of using credit cards?

· To what extent do the advantages outweigh the disadvantages?

· To what extent do the advantages and disadvantages of using credit cards apply to using other popular forms of credit (mortgage-lending, borrowing for college, taking out a car loan)?

Tutorial 2:Using Credit Wi$ely

Access: Using Credit Wisely.pdf/+Bank of information folder

Read the information indicated and answer the following questions:

· What conclusions can you draw about using credit wisely from reading these pages?

· What does “the 10 percent rule” account for concerning the question of credit and do you think it is always wise to follow it?

· What are the basic types of credit and which type do you consider the most appealing for you?

· What is the difference between closed-end or installment credit and open-end or noninstallment one? Give examples of the two types. Which type usually has collateral?

· Have you ever experienced the main credit warning signals? What do you think is the best strategy to avoid them?

· How many types of credit cards do you know? Are they different?

· How are client’s interest charges usually calculated?

· What are the best ways to avoid credit card traps?

Tutorial 3: Credit scoring

Establishing a good credit rating is very important. Most people need to borrow occasionally — to pay for college, a car, or a house — and can get credit only if considered creditworthy by lenders. To gain a better understanding of how creditors determine your credit worthiness, access http://www.ftc.gov/bcp/edu/pubs/consumer/ credit/cre24.htm /Bank of information

Based on what you read, explain your answers to the following questions:

· What is credit scoring?

· What would be the three most important criteria you would set in determining a credit score?

· How do lenders determine credit scores for prospective borrowers?

· How can you appeal an unfavorable credit rating? How can you improve an unfavorable rating?

· To what extent is it important for consumers to know about credit scoring?

Уважаемый посетитель!

Чтобы распечатать файл, скачайте его (в формате Word).

Ссылка на скачивание - внизу страницы.