Secure Securities

Info:

Security (often securities) - a certificate attesting credit, the ownership of stocks or bonds, or the right to ownership connected with tradable derivatives

Share (stock) -one of the equal parts into which a company's capital is divided, entitling the holder to a proportion of the profits

Bond -a certificate issued by a government or a public company promising to repay borrowed money at a fixed rate of interest at a specified time

Warm up: Financial observer.

· Divide your class into two groups and tell your students that they are going to become financial observers who are supposed to give coverage on the topic “Do Securities Bring Security?”. Half of the audience is employees of “Financial Times” unlike the other half who in their turn works for ‘Cosmopolitan’ magazine. The students should study the questions concerning the topic offered at the opposite page and choose the ones that will be topical for their article and interesting for their target audience. The students are encouraged to prolong the list of the topical questions.

· As a follow-up exercise two groups should prepare a rough copy of the article and submit it for the opponents’ discussion. The opponents will act as critics and proofreaders evaluating the contents and relevance of the article and widen the list of the questions raised.

1. Financial forecast will cast light.

The students imagine themselves in the shoes of stockholders who before investing their money should analyze the situation in the stock market. Ask the students to look through the list of the companies given at the opposite page and forecast which of them are the most worthy for putting money into in the order from the least to the most valuable. The students should explain their choice providing arguments for their choice. You get feedback and give correct answers. Finally together with the students you compare their assumptions with the results and make new conclusions.

Answers:1.CS; 2.E; 3.XOM; 4.MTU; 5.PBR; 6.QCOM;7.RIMM; 8.TEF; 9.TOT; 10.TM

2.Stocks or Bonds? That’s the question.

· Before showing a video to the students hand out the cards with the following words in them:

Debt, equity, partial owner, stock, bond, assets, liabilities, bank loan, par value, maturity date, zero-coupon bond, pay off the debt .

Check if all the words are clear to students.

Ask students to make up and present short dialogues on topic ‘The best way to raise capital is…’

Video

· After watching the video discuss the following questions in class:

o What is implied under company’s assets?

o What is the difference between stocks and bonds?

o What does coupon mean and what is the difference between a bond and a zero-coupon bond?

o How is money distributed in case of company’s bankruptcy?

· As a follow-up ask students to put themselves in the shoes of a businessmen who are about to start up a company. They should write an essay explaining their vision of raising capital in the optimal way.

Warm up. ‘Do securities bring security?’

1. What springs to your mind when you hear the word ‘stock market’?

2. What job stock markets do?

3. Would you like to work in a stock market?

4. What’s the difference between the Dow Jones and the NASDAQ?

5. Is the stock market in your country healthy?

6. What causes stock market crashes?

7. What are hot 20 blue chips to buy and to sell now?

8. What are the basic rules of day trading?

9. What companies would you like to have shares in?

10. What kind of person do you need to be to work in a stock market?

11. Do you pay any attention to the ups and downs of the stock market?

12. Where to get information about top-yielding stocks?

13. How important are stock markets to the world economy?

14. What are the differences between a bull market and a bear market?

15. Which questions would you like to ask a trader on a stock market?

1. Financial forecast will cast light.

|

Symbol |

Company Name |

Industry |

|

TEF |

Telefonica |

Telecommunications |

|

CS |

Credit Suisse Group |

Capital Markets |

|

TM |

Toyota Motor |

Automobiles |

|

E |

ENI. S. p. A. |

Oil Gas & Fuels |

|

TOT |

Total S.A. |

Oil Gas & Fuels |

|

XOM |

Exxon Mobil Corp. |

Oil Gas & Fuels |

|

RIMM |

Research in Motion |

Communications equipment |

|

MTU |

Mitsubishi UFJ Financial Group |

Commercial Banks |

|

QCOM |

Qualcomm |

Communications |

|

PBR |

Petrobras |

Oil Gas & Fuel |

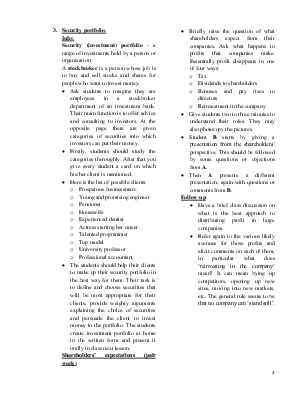

3. Security portfolio.

Info:

Security (investment) portfolio - a range of investments held by a person or organization;

A stockbroker is a person whose job is to buy and sell stocks and shares for people who want to invest money.

· Ask students to imagine they are employees in a stockbroker department of an investment bank. Their main function is to offer advice and consulting to investors. At the opposite page there are given categories of securities into

Уважаемый посетитель!

Чтобы распечатать файл, скачайте его (в формате Word).

Ссылка на скачивание - внизу страницы.