Journal of Forecasting

J. Forecast. 27, 407–417 (2008)

Published online 28 May 2008 in Wiley InterScience

(www.interscience.wiley.com) DOI: 10.1002/for.1063

Direction-of-Change Forecasting

Using a Volatility-Based Recurrent Neural Network

S. D. BEKIROS1* AND D. A. GEORGOUTSOS2 1

CeNDEF, Department of Quantitative Economics, University of

Amsterdam, Amsterdam, The Netherlands 2

Department of Accounting and Finance, Athens University of

Economics and Business, Athens, Greece

ABSTRACT

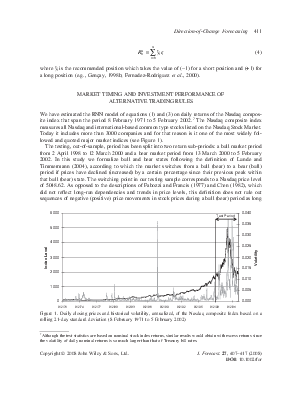

This paper investigates the profi tability of a trading strategy, based on recurrent neural networks, that attempts to predict the direction-of-change of the market in the case of the NASDAQ composite index. The sample extends over the period 8 February 1971 to 7 April 1998, while the sub-period 8 April 1998 to 5 February 2002 has been reserved for out-of-sample testing purposes. We demonstrate that the incorporation in the trading rule of estimates of the conditional volatility changes strongly enhances its profi tability, after the inclusion of transaction costs, during bear market periods. This improvement is being measured with respect to a nested model that does not include the volatility variable as well as to a buy-and-hold strategy. We suggest that our fi ndings can be justifi ed by invoking either the ‘volatility feedback’ theory or the existence of portfolio insurance schemes in the equity markets. Our results are also consistent with the view that volatility dependence produces sign dependence. Copyright © 2008 John Wiley & Sons, Ltd.

key words technical trading rules; recurrent neural networks; volatility

trading

In the present paper we explore the predictive return sign ability of trading rules that rely on a simple switching strategy: positive predicted returns are executed as long positions and negative returns as short positions. A similar strategy has been employed, with considerable success, by a number of other researchers. Gençay (1998b) examines the profi tability of a simple trading rule, applied on the DJIA index, where signs are modeled as a function of the past returns and are estimated by a feedforward network, a class of artifi cial neural networks (ANN). The results of this simple model indicate that nonparametric models with technical rules provide excess returns when compared to a simple buy-and-hold strategy. Fernández-Rodriguez et al. (2000) conduct a similar exercise for the

![]()

* Correspondence to: S. D. Bekiros, CeNDEF, Department of Quantitative Economics, University of Amsterdam, Roetersstraat 11, 1018 WB Amsterdam, The Netherlands. E-mail: S.Bekiros@uva.nl

Madrid stock market general index and show that a simple trading rule based on ANNs is always superior to a buy-and-hold strategy during bear market conditions. Pesaran and Timmermann (1994) examine whether the predictability of Standard and Poor’s 500-index returns could have been historically exploited by investors to earn profi ts in excess of a buy-and-hold strategy. In general terms they fi nd that the returns from the switching strategy are higher than those from the passive one for annual returns, even when transactions costs are high. They also fi nd that the predictive power of various economic factors is increased during volatile periods.[1]

The present paper advances the existing literature by exploring the predictive ability of trading rules that incorporate, among others, forecasts of the conditional volatility changes over the next trading period. The empirical investigation of the relation between stock return volatility and stock returns has a long tradition in fi nance (Bekaert and Wu, 2000) According to the ‘time-varying risk premium theory’ the return shocks are caused by changes in conditional volatility. When news arrives in the market the current volatility increases and this causes upward revisions of the conditional volatility since there is a well-documented fact that volatility is persistent. This increased conditional volatility has to be compensated by a higher expected return, leading to an immediate decline in the current value of the market. Therefore, in the case of bad news, the volatility feedback effect reinforces the initial drop in stock market prices. However, when good news arrives in the market and volatility increases, prices decline to induce higher expected returns, thus offsetting the initial price movement.[2] An alternative rationalization for the presence of conditional volatility revisions in the trading rule may be offered by invoking trigger strategies in the equity markets (Krugman, 1987). Participants in portfolio insurance schemes react whenever the maximum expected loss, as measured for example by the value-at-risk (VaR), reaches a predetermined level and therefore share price dynamics are being driven, partly, by revisions in the measured conditional volatility.[3] If we assume a continuity of portfolios that deviate to a varying degree from their predetermined level of VaRs, then each time the conditional volatility rises a number of those portfolios will hit their risk limits and this will generate a reallocation of assets towards safer ones. Each time portfolio insurers leave the market the stock prices must fall in order for the other investors to be given an incentive to hold a larger quantity of stock. If we further assume a rational expectations world then investors take into account the effects of portfolio insurance schemes and no step drop in stock prices is being observed. In an intriguing recent paper Christoffersen and Diebold (2003) show

Уважаемый посетитель!

Чтобы распечатать файл, скачайте его (в формате Word).

Ссылка на скачивание - внизу страницы.