Profitable candlestick trading strategies—The evidence from a new perspective

Tsung-Hsun Lu a,⁎, Yung-Ming Shiu b, Tsung-Chi Liu a

a Department of Business Administration, National Cheng Kung University, Taiwan b Department of Risk Management and Insurance, National Chengchi University, Taiwan

![]()

![]()

Article history:

Received 12 April 2011

Received in revised form 2 February 2012

Accepted 22 February 2012 Available online 3 March 2012

![]()

JEL classification:

G11

Keywords:

Technical analysis

Candlestick reversal patterns

Bootstrapping

![]()

![]()

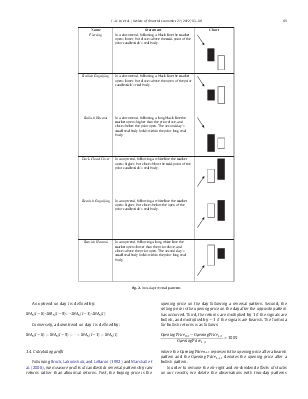

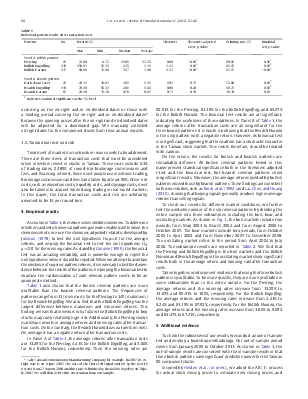

This paper aims to investigate the profitability of two-day candlestick patterns by buying on bullish (bearish) patterns and holding until bearish (bullish) patterns occur. Our data set includes daily opening, high, low, and closing prices of component stocks in the Taiwan Top 50 Tracker Fund for the period from 29 October 2002 through 31 December 2008. We examine three bullish reversal patterns and three bearish reversal patterns. We find that three bullish reversal patterns are profitable in the Taiwan stock market. For robustness checks, we evaluate the applicability of our results to diverse market conditions, conduct an out-of-sample test and employ a bootstrap methodology.

Crown Copyright © 2012 Published by Elsevier Inc. All rights reserved.

![]()

Academicians have been skeptical of technical analysis (Malkiel, 1981). In practice, however, traders generally adopt technical analysis in their daily trading. Billingsley and Chance (1996) find that about 60% of commodity trading advisors heavily or exclusively rely on computer-guided technical trading systems.

Emotion and irrational beliefs have been documented as important factors affecting market prices and technical analysis could purportedly gauge the extent of emotional components in the markets (Nison, 1991). From the growing body of literature on behavioral finance, it seems that investors do not behave completely rationally as they face gain and loss. Technical analysts can transform investors' mental emotion into charts to demonstrate investors' real fear and greed. In this way, technical analysis appears to be consistent with behavioral finance. For example, positive feedback rules (De Long, Shleifer, Summers, & Waldmann, 1990) probably could explain trend-chasing in price movements. The anchoring effect (Tversky & Kahneman, 1974) seems to be in accordance with the support and resistance trading rules in technical analysis.

Candlestick analysis originated from Japan in 1700s and was initially used for rice forward contracts trading (Nison, 1991). It is the oldest technical analysis method and now is used to reveal the shifts in supply and demand forces by tracking daily price movements.

|

⁎ Corresponding author at: 8F, No. 3, Fuqiang 3rd St., East Dist., Tainan City 701, Taiwan. Tel.: +886 6 208 0137; fax: +886 6 208 0179. E-mail address: r4895107@mail.ncku.edu.tw (T.-H. Lu). |

The motivation for this research is to fill in the gap in the literature on candlestick analysis. Prior studies generally focus on the shortterm profitability of candlestick analysis, probably because candles have value with the maximum holding period of ten days (Morris, 1995). Our research contributes to the literature by examining the long-term profitability of candlestick trading strategies. Unlike prior technical analysis literature on candlesticks, this study is the first study that rigorously investigates these strategies by buying on bullish (bearish) patterns and holding until bearish (bullish) patterns occur. Moreover, early empirical studies (Alexander, 1964; Fama & Blume, 1966) find that profits made through technical analysis are eroded by transaction costs. We therefore examine and report the average profit after commissions and taxes.

For robustness, we further test the predictive power of six reversal patterns by dividing entire sample into three market conditions. We also conduct an out-of-sample test and employ a bootstrap methodology. Our empirical results reveal that the three bullish reversal patterns, especially the Piercing pattern, are significantly profitable in the Taiwan stock market.

The rest of this paper is structured as follows. Section 2 reviews the literature. Section 3 describes the data and the methodology. Section 4 discusses the empirical results. Section 5 extends the additional evidence. The last section concludes the paper.

There is no general consensus on the effectiveness of candlestick

|

1058-3300/$ – see front matter. Crown Copyright © 2012 Published by Elsevier Inc. All rights reserved. doi:10.1016/j.rfe.2012.02.001 |

charting in the literature. Marshall, Young, and Rose (2006) propose an empirical framework for predictive power of candlesticks. They employ the bootstrap methodology to retest the results, and find

Уважаемый посетитель!

Чтобы распечатать файл, скачайте его (в формате Word).

Ссылка на скачивание - внизу страницы.