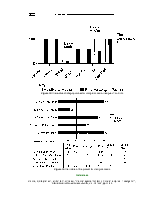

The economic contribution that small firms make is being increasingly recognised. Consequently robust strategic benchmarks for small firms must be extremely valuable not just for the firms themselves but also for the wider economic community. The Competitive Analysis Model (CAM) is a new approach to the strategic benchmarking of small firms. Currently this model comprises 893 firms on which are held 320 separate data items. These data items are used to provide individual firm reports so that participating firms can benchmark their performance in terms of measures such as: growth rates, internal performance measures, external performance measures and strategic priorities. The benchmarks are provided in two major manners: sectoral comparisons so that a firm can benchmark its performance with others of a similar size in the same industry sub-sector and cross-sectional comparisons so that a firm can benchmark its performance with others of similar size irrespective of the industry in which they operate. This article describes the operation of CAM and illustrates its operations through a typical CAM report.

Research paper

Benchmarking; Modelling; Small firms.

Benchmarking: An International Journal

6

2

1999

125-148

MCB UP Ltd

1463-5771

The analogy between human performance and firm performance has been used often in strategic planning (see for example Hendry et al., 1991; Cromie et al.,1996). Usually it is applied as shown in Table I.

For many individuals and for many firms the above can be an inherently attractive and instructive approach to measuring and improving performance.

Individuals often measure their “performance”[1] against others and then seek to improve it by imitating the behaviours of other more successful individuals. Thus people often try to improve their performance or health through changing their:

When individuals assess their health in this fashion they tend not to use a single numeraire but, rather, they use a variety of ordinally scaled measures such as:

This type of performance measurement is natural, meaningful, accurate and easily understood. A similar approach to measurement will now be considered for strategic firm performance.

For all firms their annual report is a measure of their strategic and operational effectiveness. In such reports the main indicator is often one or more cardinal measures of financial performance – profits, dividends, return on investment, return on shareholders’ funds.

Although such measures are necessary and do indeed record a firm’s per-formance, from a strategic perspective they suffer from the following limitations:

1. Cardinal measures, such as, for example, profits of a certain level, or a return on assets (ROA) of 25 per cent do not capture the complex mosaic of most firms’ strategic positions. Thus these types of figures do not provide any information on:

o how the figures were achieved;

o what actions could be taken to improve performance; and

o the quality of this firm’s performance relative to similarly structured firms.

1. The measures are static and do not capture the dynamic and usually lagged effects that strategies often have. For example, a major drive to improve quality may, in the short run, depress financial performance measures but ought, in the long run, to have extremely beneficial effects.

2. The measures do not provide a basis for a comprehensive discussion on the causes of performance. They merely record the performance. Hence these measures do not provide the basis for informed consideration of the strategic actions necessary to improve performance.

Уважаемый посетитель!

Чтобы распечатать файл, скачайте его (в формате Word).

Ссылка на скачивание - внизу страницы.