The most commonly used valuation ratios are:

There is no universal agreement on ratio values that define value or growth. Here’s my simplified take.

|

Defining value and growth |

|||

|

Ratio |

Value |

Growth |

Overpriced Growth |

|

P/E |

Less than 15 |

More than 20 |

More than 50 |

|

P/S |

Less than 2.5 |

More than 3 |

More than 10 |

|

P/B |

Less than 3 |

More than 5 |

More than 15 |

Stocks with valuations in the gaps between the value and growth definitions -- say, a P/E of 18 and a P/B of 4 -- could be in either category, depending on the circumstances. Valuations in the Overpriced Growth column define stocks that many investors would consider overpriced

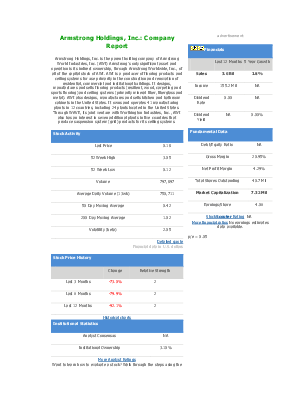

ElkCorp: Company Report

ElkCorp (Elk), through its subsidiaries, is primarily engaged in the manufacture of Elk premium roofing and composite building products. Within the building products sector, the Company operates in two segments: Premium Roofing Products, which manufactures premium laminated fiberglass asphalt shingles and accessory products, together with coated and uncoated non-woven fabrics used in asphalt shingles and other applications, and Composite Building Products segment manufactures composite wood decking, railing, marine dock, fencing and other original equipment manufacturer products. It also has another segment Other, Technologies, which includes the operations of Chromium Corporation (Chromium) and Elk Technologies, Inc. During the fiscal year ended June 30, 2005 (fiscal 2005), Elk acquired RGM Products, Inc. and Railwayz Inc. During fiscal 2005, the Company sold its subsidiary, Ortloff Engineers, LTD, and substantially all of the assets of its subsidiary, Cybershield, Inc.

Detailed quote Financial data in U.S. dollars

Historical charts

More Analyst Ratings Want to learn how to evaluate a stock? Walk through the steps using the Research Wizard. |

advertisement

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Continental Materials: Company Report

Continental Materials Corporation operates primarily within two industry groups, construction products, and heating, ventilation and air conditioning (HVAC). The Company has four segments: the Heating and Cooling segment, the Evaporative Cooling segment, the Door segment, and the Concrete, Aggregates and Construction Supplies segment. The Heating and Cooling segment produces and sells gas-fired wall furnaces, console heaters and fan coils. The Evaporative Cooling segment produces and sells evaporative coolers. Doors are fabricated and sold along with the related hardware from the Company's wholly owned subsidiary, MDHI of Pueblo, Colorado. The Company manufactures evaporative air coolers at a plant in Phoenix, Arizona. It also produces ready-mix concrete. It sells hollow metal doors, door frames and other hardware throughout the United States |

Уважаемый посетитель!

Чтобы распечатать файл, скачайте его (в формате Word).

Ссылка на скачивание - внизу страницы.